55+ what percent of your mortgage should be of your income

Heres how lenders typically view DTI. Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage.

Percentage Of Income For Mortgage Rocket Mortgage

Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income.

. Lock Your Mortgage Rate Today. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Were Americas Largest Mortgage Lender.

Apply Online To Enjoy A Service. Ad 10 Best House Loan Lenders Compared Reviewed. Web Mutual of Omaha Mortgage offers a mortgage calculator to assist home buyers with an in depth and easy way to help calculate a mortgage payment.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Apply Now With Quicken Loans. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

2 To calculate your maximum monthly debt based on this ratio multiply your. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Mortgage Options Calculate Payments.

Compare More Than Just Rates. Lock Your Rate Today. Comparisons Trusted by 55000000.

Ad Are you eligible for low down payment. Web Most lenders must follow strict policies that limit a mortgage payment to a lower percentage that commonly being 28 percent. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Were Americas Largest Mortgage Lender. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad Compare Mortgage Options Calculate Payments. John in the above example makes. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The 35 45 Model. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

And they see a 28 DTI as an excellent one. Get Instantly Matched With Your Ideal Mortgage Lender. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web A 15-year term. Apply Now With Quicken Loans. Highest Satisfaction for Mortgage Origination.

Lock Your Mortgage Rate Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad 10 Best House Loan Lenders Compared Reviewed.

Apply See If Youre Eligible for a Home Loan Backed by the US. Lock Your Rate Today. Ideally that means your monthly.

But some borrowers should set their personal. Find A Lender That Offers Great Service. Mary has an average.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Save Real Money Today. Comparisons Trusted by 55000000. Ad Calculate Your Payment with 0 Down.

Find all FHA loan requirements here.

Percentage Of Income For Mortgage Payments Quicken Loans

Hexmuv48oue1zm

How Many Homeowners Have Paid Off Their Mortgages Fivethirtyeight

Here S How To Figure Out How Much Home You Can Afford

What Percentage Of Income Should Go To Mortgage Morty

:max_bytes(150000):strip_icc()/why-retire-at-55-2388841-final-7bf4aaf54bf645edb08167c28468f077.png)

Before You Retire At 55 Consider These 3 Things

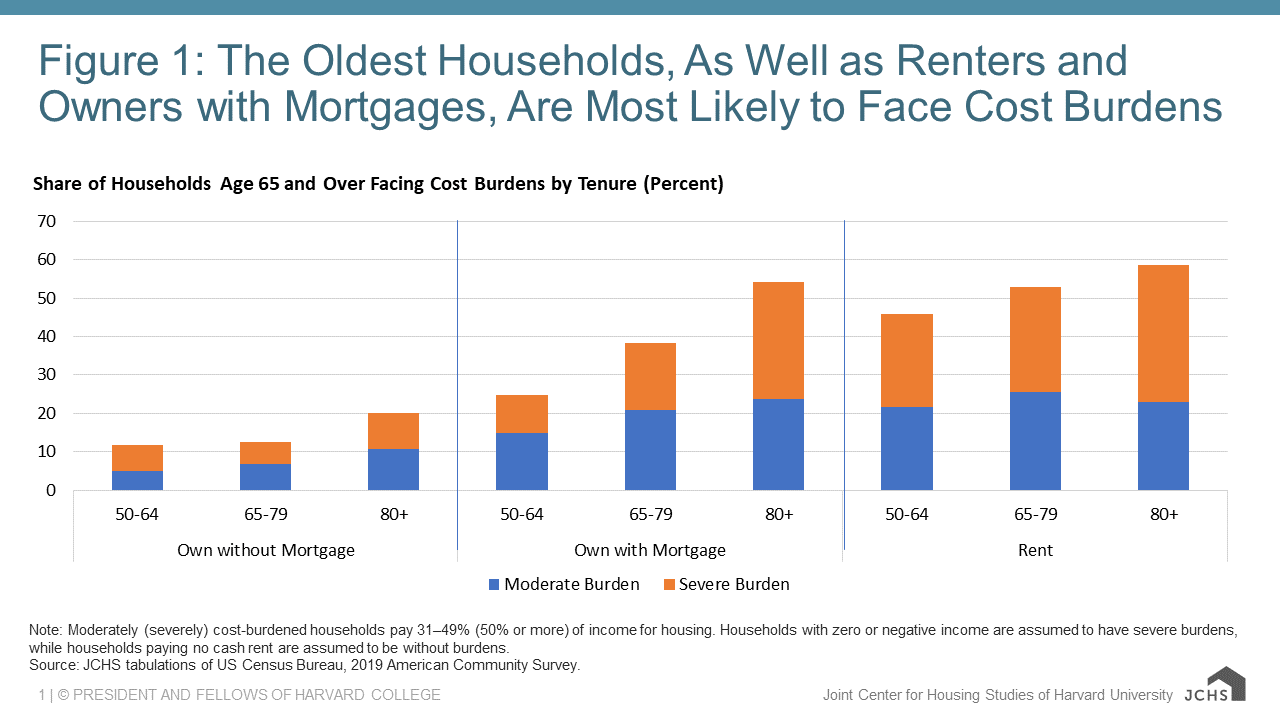

Ten Insights About Older Households From The 2020 State Of The Nation S Housing Report Joint Center For Housing Studies

How Much Home Can You Afford Advanced Topics

How Much House Can I Afford Moneyunder30

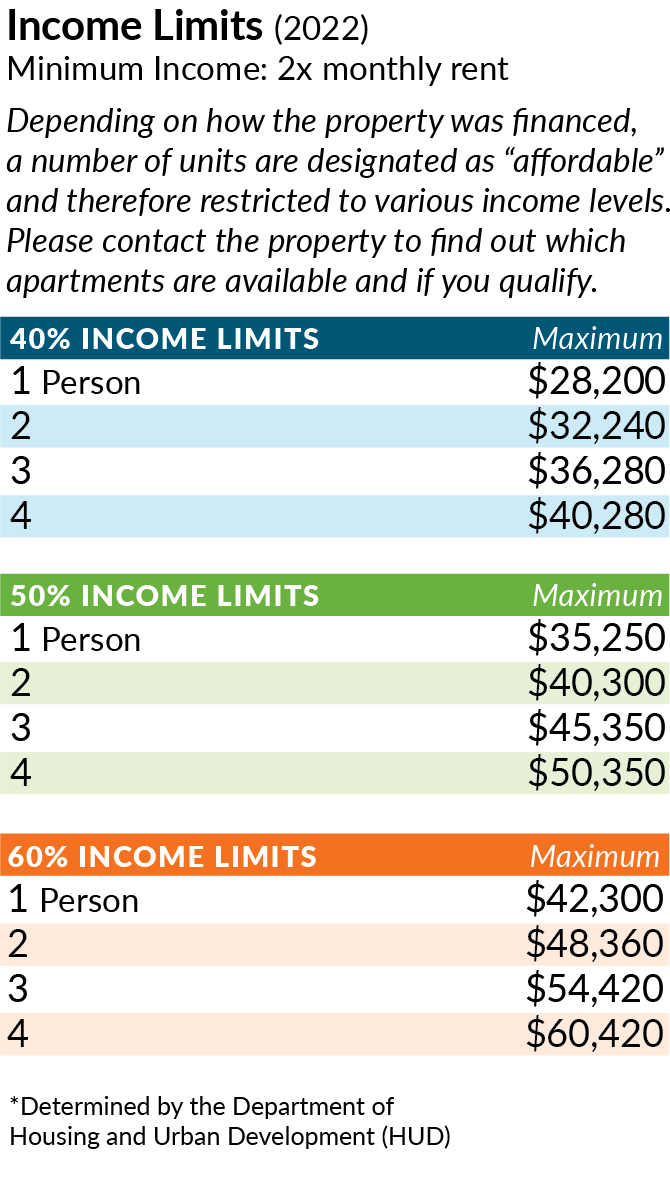

55 Plus Senior Community 55 And Older Communities For Senior Living

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Your Mortgage Hometap

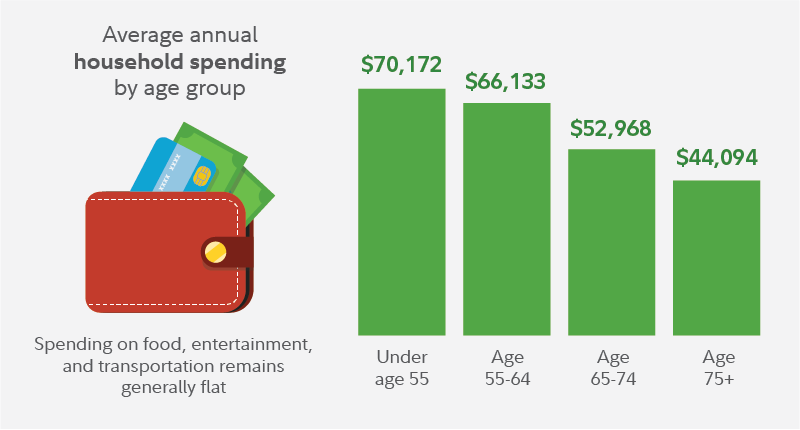

How Much Will You Spend In Retirement Fidelity

What You Need To Know About The New Social Security Benefit Increase Pbs Newshour

Glossary Of Mortgage Lending Terminology Rocket Mortgage

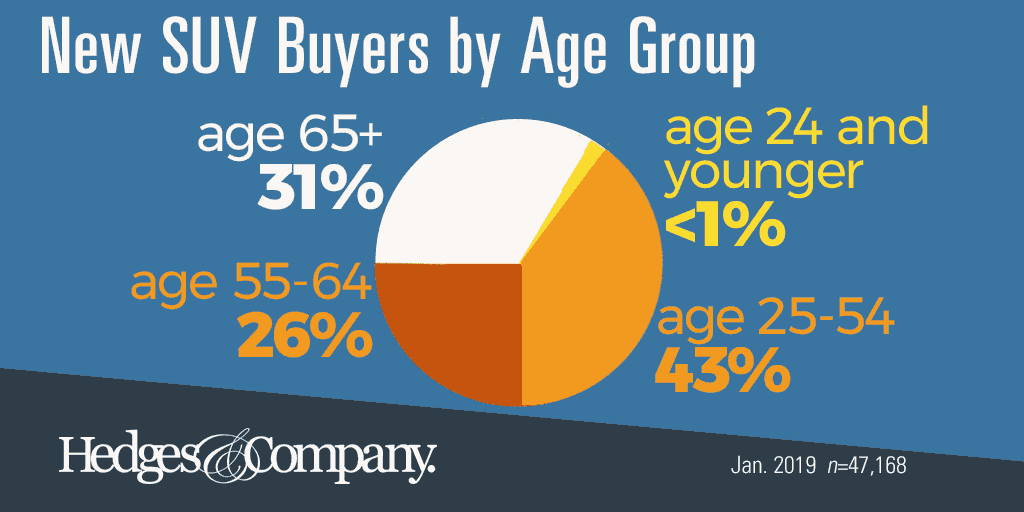

Automotive Trends New Car Buyer Demographics

American Families Face A Growing Rent Burden The Pew Charitable Trusts